Debt Recycling - Powerful Tax efficient approach to leveraging your Home Loan for Investing Purposes

Debt Recycling has the potential to save you $10,000’s of dollars.

Today I’m going to explain a term you may have heard before known as Debt Recycling or DR (this is explicitly related to Australian laws) that has the potential to save you $10,000’s of dollars over the course of years. Debt Recycling aims to convert Non-Deductible Debt into Tax Deductible Debt. It’s important to understand the difference between the two.

Explaining Good Debt & Bad Debt

Non-Tax Deductible Debt (Bad Debt) - PPoR (Principal Place of Residence) mortgage. Repayments are paid with after tax income.

Tax Deductible Debt (Good Debt) – Investment Debt e.g money that you borrow for an income producing purpose (Property, Shares, etc).

The aim of Debt Recycling is to minimize bad debt & maximize good debt.

Let’s now look at the mechanics of Debt Recycling.

Mechanics of Debt Recycling

Most people will look to do Debt Recycling when they have an owner-occupied mortgage & you have an amount sitting in your offset account that you want to use to purchase shares or an investment property.

Here is an example scenario of wanting to buy shares using DR

1. Owner Occupied Mortgage: $800K at 6% interest p.a

2. Monthly Repayments: $4,800

3. Offset Account: $100K

4. Now you could leave the $100K in your offset account to reduce your interest repayments. However, a better approach would be to pay the $100K from your offset account into your mortgage redraw account, this would reduce your repayments to $4250.

5. Next you would get in touch with your bank and apply for the $100K as a separate investment loan (interest only - IO). You would then use this $100K to invest straight into Shares which are for an income producing purpose and thus, the interest will be Tax Deductible.

Using this method, we have Debt Recycled $100,000. It does not matter if we used cash or the debt recycling strategy the total debt would remain the same at $800,000. The difference is in the total tax-deductible debt.

As you can see above, we come to $6,000 in Tax Deductible Interest, now say you’re in the 32.5% income tax rate bracket in Australia (earning between $45,001 - $120,000). You will save on tax and receive $1950 for that year.

Let’s break this down further with 2 diagrams to show the difference between investing with DR & investing without DR.

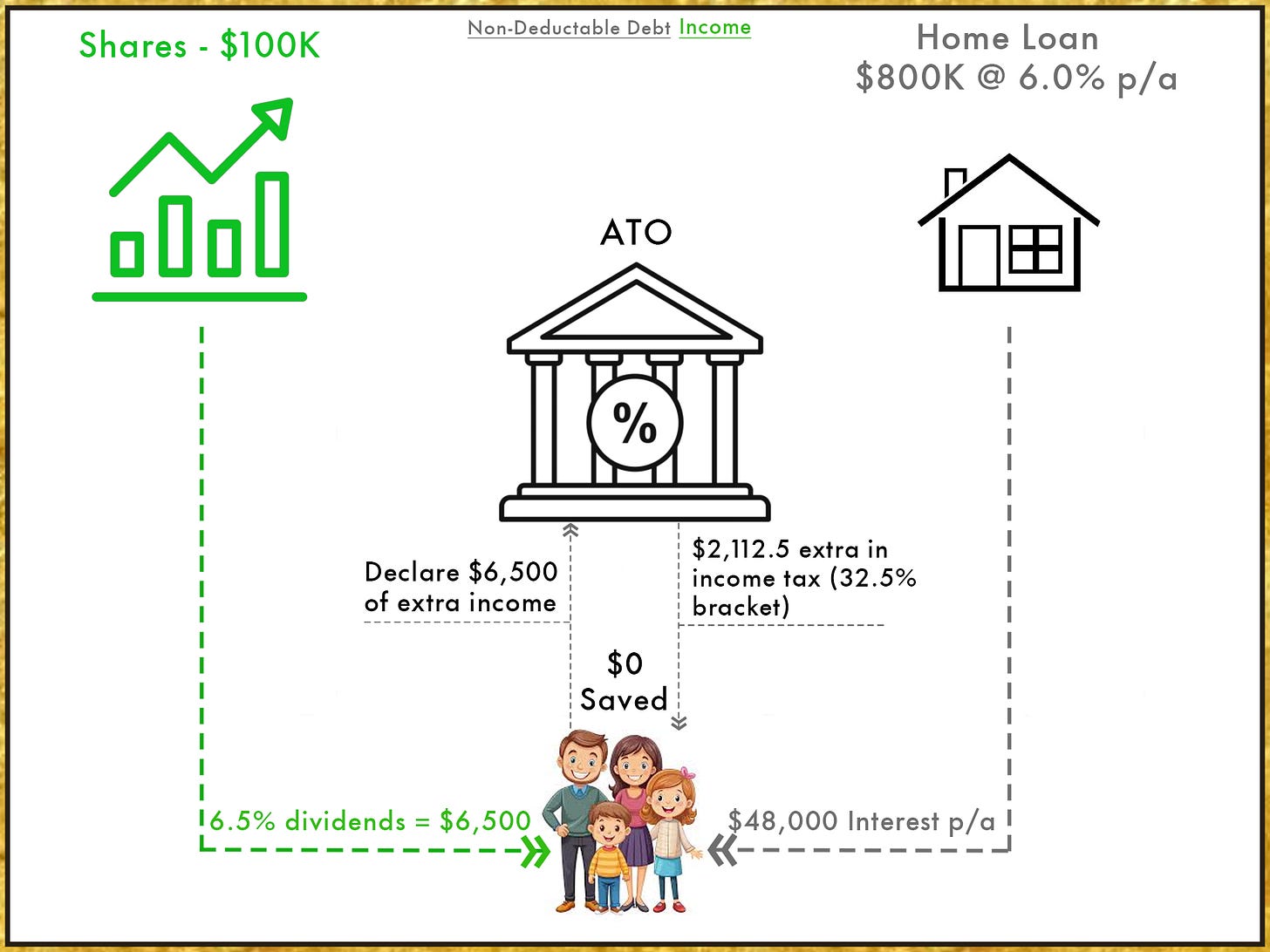

Investing without DR

In the above scenario we’re investing that $100,00 with after tax income, we don’t have any tax on our PPoR (Principal Place of Residence) home loan. We can use DR to convert the borrowed money into an income producing purpose and create deductible debt for ourselves.

Let’s look at scenario 2 now in which we use DR.

Investing with DR

Looking at this scenario, we have converted bad debt into good debt & were able to use the $100,000 that we had redrawn to become an investment loan. We were then able to use this investment loan to buy shares which are for an income producing purpose and thus can now claim a deduction on the accrued interest which saved us $1,950 for that year.

Now there is more upside to DR, I’m posting this on Substack we’re many fellow active investors are who can generate returns of 15-20%+ per year. The upside here is obviously the $100K you invest in shares could beat the 6% interest loan rate quite significantly per annum. However, if you are more of a passive investor then putting that $100K into ETF’s might be more sensible, of course you could always use the investment loan towards purchasing an investment property as well.

I hope this gives a clear understanding of the power that Debt Recycling has and how you can utilize it to your advantage. I may dive deeper into DR when it comes to doing it with a Trust, the extra benefits of executing DR while in a higher tax bracket & the effects of Capital Gain Events in a future article.

Thank you reading my article about Debt Recycling.

Stuart G

Disclaimer:

The content of this analysis is for informational purposes only and should not be considered financial or investment advice. The opinions expressed are my own and based on publicly available information at the time of writing. Before making any investment decisions, please conduct your own research or consult with a professional financial advisor to assess your individual situation. Investing in the stock market involves risk, and past performance is not indicative of future results.

Any risks with this strategy?