Vysarn (ASX:VYS) Vertically integrated end-to-end water service, NPBT CAGR of 100%+ over the past 3 years, Massive Untapped Water Tolling Revenue

Vsarn (ASX:VYS) NPBT CAGR of 100%+ over the past 3 years, Massive Untapped Water Tolling Revenue

The company I will be analysing today is Vysarn Limited (ASX:VYS). Vysarn primarily focuses on providing the Western Australian mining industry with a vertically integrated end-to-end water service, with a large focus on the iron-ore market.

Contents:

Summary of Business Model

Growth Potential

Management Quality

Risks

Valuation

Conclusion

Summary of Business Model

Vysarn has a Market Capitalisation of $224M with a Share price of $0.425 & currently has 7 wholly owned subsidiaries under it's umbrella. These include the following:

Pentium Water

COMP Consulting group

Pentium Hydro

Pentium Test Pumping

Project Engineering

Vysarn Asset Management

Waste Water Services

It's important to understand what each of these divisions do for Vysarn overall, this company has a complex number of Revenue streams that I will try to summarize & keep concise, listing only the important information regarding each of them.

Advisory Division - Generates 11.2% of Revenue

Pentium Water

First up is Pentium Water, which makes up part of Vysarns advisory division, they provide consulting services relating to water extracting and water management. Their team include hydrologists, hydrogeologists, groundwater and surface water modellers, water resource engineers, environmental scientists, and environmental planners. They provide consulting advice on:

Integrated storm water and urban water management

Mine water management

Environmental planning and management

Pentium Water was created in Febuary 2022, they currently have a team of 30 employees. In FY23 they generated Revenue of $4.1M, they increased this by 17.3% in FY24 with $4.7M, an EBITDA of $1M & a NPBT of $956K in FY24.

Pentium Water was established to diversify Vysarns client base to help grow the overall business, Pentium Water is headed by Shane McSweeney who has a background of over 16 years of applied environmental science and hydrological engineering, the team aim to expand into a wider range of consultancy sectors moving forward.

CMP Consulting Group (CMP)

CMP also makes up part of Vysarns advisory division, they provide engineering based consulting services such as:

Potable Water Treatment and Distribution

Wastewater Transfer and Treatment.

Recycled Water Treatment and Distribution

CMP was acquired in December 2024 & interestingly they are based in Victoria giving Vysarn a national foothold on the east coast of Australia. As of the time of this article, CMP hasn't hit the financial statements yet. It is worth noting that this acquisition was also executed to drive growth & diversify the groups client base.

Industrial Division - Generates 63.4% of Revenue

Pentium Hydro

Moving onto Vysarns industrial division, Pentium Hydro was Vysarn's first Brach of the company, it's also by far their largest division when it comes to generating Revenue. Pentium Hydro is one of the largest dedicated hydrogeological drilling contractors in Australia. They provide drill rigs to drill holes in the ground, while also supplying support equipment across their own hydro drilling operations in Western Australia. Services include:

Dual Rotary Drilling

Dual Tube Flooded Reverse Drilling

Conventional Waterwell Drilling

Geotechnical & Environmental Monitoring

Pentium Hydro currently operates a fleet 12 drilling rigs. Pentium Hydro generates revenue by loaning these rigs out under contracts, they generated $55M in Operational Revenue for Vysarn in FY24, total 73% of the groups total Operational Revenue. As of FY24 Pentium Hydro has an EBITDA of $13.3M & a NPBT of $9.1M.

Pentium Hydro has been securing contracts quite steadily, in February 2022 they secured a contract with BHP that ran over three years. Management had this to say at the time.

“They will be an important client for our company going forward and the award of the contract is another strong endorsement of the quality of Pentium’s service offering.”

This generated $2.8M in Revenue. Pentium Hydro also secured and executed work for IIuka Resources at its Cataby mine in Western Australia, while also securing a $13 million bore field drilling contract with Australian Potash at its Lake Wells sulphate of potash project.

Pentium Test Pumping

Pentium Test Pumping operates a fleet of rigs that can carry out pump testing services (hence the name). These services include the following:

Step Testing

Constant Rate Testing

Artesian Well Testing

Recovery Testing

Pentium Test Pumping generated $3.6M in Operational Revenue in FY24, up 31.8% from the previous FY. with an EBITDA of $1.1M & NPBT of $524k. This is one of the fastest growing divisions for Vysarn currently.

Pentium Test Pumping currently own two units both under operation, with the second unit being capable of performing injection testing as well as test pumping. Pentium Test Pumping specialize in aquifer characterisation testing for all Australian groundwater industries. Their work scope outlook underpin deployment and utilisation of both rigs in second half and beyond.

Technology Division - Generates 25.3% of Revenue

Waste Water Services

Vysarns last division in their technology branch, Vysarn acquired 100% of Waste Water Services in September 2024 for $7.5M cash consideration. Management stated that Vysarn acquired Waste Water Services as they believe their are organic growth opportunities available for new and existing clients.

Management plans to capitalise on growing pipeline wastewater treatment plants for the resource sector, the expansion of recurring revenue streams via an increase in the number of wastewater rental units, and the development of municipal water treatment opportunities. Waste Water Services offer:

Sewage Treatment

Industrial Waste Water Treatment

Portable Water

Pump Stations

Storage Tanks

We don't have concrete data on how Waste Water Services has performed, however in Vysan's latest FY25 update management stated that Waste Water Services is ahead of management expectations so far.

Project Engineering

Project Engineering specializes in Managed Aquifer Recharge (MAR) systems, they leverage their own market leading valve technology to inject water back into aquifers. This essentially means they refill dewatered groundwater. The slide below provides a detailed example on the process.

Source: Vysarn’s Website

Project Engineering has supplied over 400 MAR injection units to the different mining sectors across Western Australia to date. Project Engineering systems are presently able to inject up to 180 gigalitres of water per annum for clients, with water salinity ranging from fresh to hyper-saline, and water temperatures from ambient to 65°C. Project Engineering also offer the following services for their MAR systems:

Inspections & Auditing

Technical Support

Equipment Refurbishment

Project Engineering mainly service tier 1 mining clients (A tier 1 mining client is a mining company using long run commodity prices to generate >$300-600m pa of revenue for >20 years and is in the bottom quartile of the cost curve. Examples are BHP, Rio Tinto, Fortescue.)

Project Engineering was 100% acquired in September 2022 at an enterprise value of $2.6M. Project Engineering generated $11.8M in Operational Revenue for the FY24, up a substantial 65.1% from the previous FY, mainly driven by tier 1 iron ore mining companies seeking to adopt the use of MAR technology at a growing pace. More on this in the Growth Potential section later. Project Engineering boasts $4M EBITDA for FY24, that's a 137% increase as well as a 159% increase in NPBT when compared to FY23.

Asset Management Division

Vysarn Asset Management

Vysarn Asset Management has been established to own and toll the vast amount of water stored in aquifers in the Pilbara region of Western Australia. The water here is used to supply water to major mining operations, government mining projects and more.

Vysarn Asset Management will liaison with traditional owners of the land to sign & form agreements to implement aquifers. Vysarn Asset Management will then toll the water & sell the water while also building transmission pipelines so the water can be transported to end-users.

At it's core, Vysarn Asset Management is the finance manager of the project. Because of this, they will generate revenue by earning management fees on the assets under management. They will charge a percentage on management fees most likely around 1%-5%.

Richard Lourey was appointed as Managing Director of VAM in November of 2023. Richard was previously the Executive Director at JP Morgan Securities in which he established Australia’s first dedicated water fund.

Growth Potential

Now that we have an understanding of the different divisions with Vysarn & how they operate, we will move onto the growth opportunities that Vysarn could capitalise on.

Looking into Vysarns industrial division first, according to Mork Water.

"40% of mining operations in the Pilbara are projected to be below the water table by 2040, requiring large scale dewatering efforts. At least 50% of the extracted water will be returned to groundwater via reinjection bores to minimise the effect on the water table of mining operations."

Given Pentium Hydro is Vysarn's most established branch & them having a ready to go fleet of drillers that are built to mine below the water table, it is clear that they are set to see high-growth in this area. Vysarn will need to continue to build up it's fleet so that it can capitalize as much as possible with this change in Iron ore mining. In Vysarn's FY25 investor update they stated additions of two new tier-1 iron-ore clients.

As mentioned earlier, Pentium Test Pumping has a rig that is capable of performing injection testing as well as test pumping. Vysarn is the only company in Australia to currently offer this service, given it a competitive advantage. If Pentium Test Pumping can monopolise these rigs and be the forefront provider of this service, then they will not only create a strong Moat for themselves, but they will also see high-growth going forward in this division.

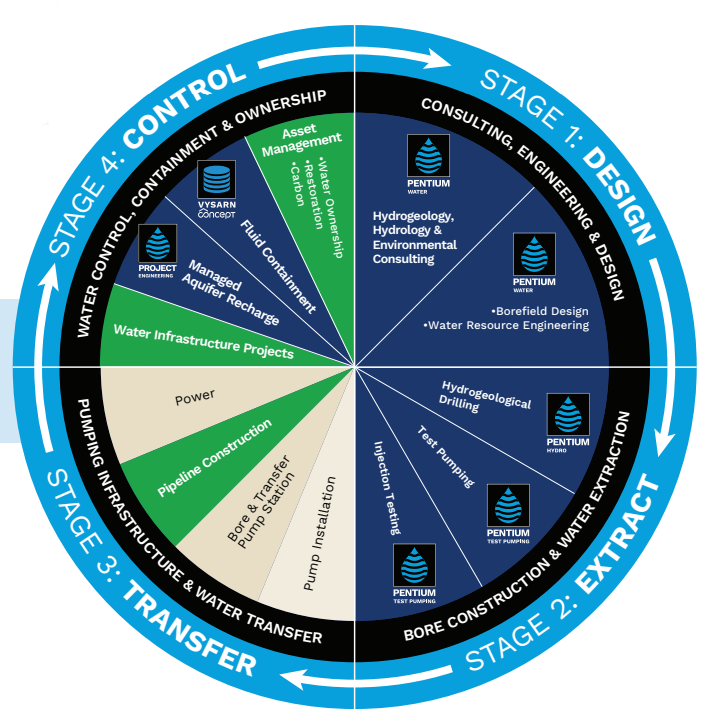

As stated earlier, Vysarn aims to be the premium supplier of end-to-end water services in Western Australia and eventually beyond. The below graph details how they aim to provide this end-to-end service.

Similar to Pentium Test Pumping, Project Engineering is the only provider of MAR technology in the Western Australia mining industry. Excess mine water is no longer being considered a waste product and mining companies are looking for new solutions to manage their mine water. MAR technology is being increasingly adopted by the mining industry as a way of returning water from dewatering operations back to the source aquifers. If Vysarn can leverage this increasing dependency on MAR technology, then they will see immense growth in the future.

Perhaps Vysarns the greatest avenue for growth lies with the Asset Management division. As discussed above they have the ability to generate Revenue by tolling water. From Vysarns FY25 Investor Report they state.

"Beginning of what Vysarn considers a generational infrastructure spend that is targeting the upgrade and renewal of water and wastewater infrastructure."

This is referring to the ability to generate Revenue by tolling water. If they can capitalise on the substantial and growing water issues in the iron-ore sector, then the amount of revenue that could be generated is astronomical. Vysarn also recently announced they have applied for a 5C Water Licence in Western Australia which will allow them to take a specified amount of water groundwater or surface water resource.

Vysarn have shown that want to expand Nationally & they have with the acquisition of CMP Consulting Group. If they see other opportunities to expand interstate or perhaps internationally then I believe they will take them. The slide below does a good job of outlining Vysarns long-term strategic goals.

Management Quality

As always I like to judge a companies management team based off how they effectively allocate capital to drive future growth. Starting out we have Peter Hutchinson the Chairman of Vysarn. Stated on their website, Peter was the previous founding director of Forge Group Ltd, Peter took Forge from a market cap of $12m in 2007 to $450m in 2012 before resigning as CEO, this is quite impressive.

James Clement is the Managing Director & CEO. James was previously the Managing Director and CEO of sustainable agricultural company Mareterram Ltd. Steve Dropulich is the Executive Director & has 30 years experience in the Australian energy and infrastructure services sector, he was brought in to help steer the growth of key senior human resources investments. Shane McSweeney is the Executive Director & has nearly 20 years of experience in advisory services, strategic management, and corporate governance, while Sheldon Burt is a Non-Executive Director while also being a co-founder of its subsidiary Pentium Hydro.

Acquisitions

Looking at how Vysarns acquisitions have performed to give us insight into the management quality. Project Engineering was acquired for $2.6m in cash in August 2022 & delivered $11.8M Revenue in the FY24 alone, this shows very strong ROIC.

Looking at how management has handled the financials. Vysarn has grown NPBT CAGR of 100%+ over the past 3 years & is sitting at a respectable $14.8M in Operational Cashflow as of 1HFY25 with a NPBT of $5.2M. Vysarn has very little debt sitting at only $0.2M Long-Term Debt, their Non-Current Deferred Tax Liability is a little higher then I like to see sitting at $4.9M however this isn't overly concerning.

There is currently 40% of shares held by insiders, this is appealing to me & something that does provide a level of security knowing that the management team believe so heavily in Vysarn. Vysarn currently does not pay out any dividends.

I believe overall management has shown strong leadership with smart & effective acquisitions, securing licensing agreements with traditional owners & the WA government requires delicate negotiations. The management team has steered the ship well so far and hopefully can continue to do so leading into the future years.

Risks

Let's firstly look at the regulatory and compliance risks, changes in government regulations, environmental laws, and industry standards can create compliance challenges for the company. If Vysarn is unable to adapt to regulatory changes, it could face legal liabilities or operational disruptions.

Dealing with the Traditional Owners of the land involves constant negotiations with not only them but the Australian government as well, to ensure sufficient agreements are always in place. This changing landscape can pose challenges & Vysarn will have to remain proactive to keep pushing forward in obtaining new licenses agreements to toll water.

There are also economic & industry risks as Vysarn is a company operating in the materials sector, Vysarn is susceptible to industry-specific risks, including fluctuations in commodity prices, regulatory changes, and economic cycles that can impact demand and profitability.

Vysarn’s may face contract risks as the reliance on securing and delivering contracts for its projects exposes it to risks such as contract disputes, cost overruns, and the failure to meet project requirements or deadlines.

Vysarn operates in a complex industry & has many revenue streams that they must protect & continue to grow if they want to obtain their performance targets.

Valuation

It is tricky to give a valuation of Vysarn at this point in time as most of their Revenue hits the books in the 2nd half of the FY due to the way their contracts are currently setup, however I believe I can still provide an accurate valuation given Vysarns projected figures & past performance. Vysarn currently trades at an enterprise value of $210M & are aiming to generate a $10.4M run-rate in NPATA, this leaves us with a valuation of of <20x earnings with $24.6M in Retained Earnings. Vysarn currently trades at a forward P/E of around 20. With the strong growth of Project Engineering (up 159% in NPBT YoY) & Pentium Test Pumping (up 32% in Operational Revenue), if these divisions continue to grow & Vysarn can provide an efficent end-to-end water service for the Westeran Australia mining sector, then they seem undervalued currently.

Conclusion

Vysarn is offering services to the mining industry of Western Australia that other competitors are not, this has created narrow economic moats for them for now. If Vysarn can push into the untapped water tolling market then there are significant chances of high growth periods ahead. Vysarn must continue to make smart acquisitions like they did with Project Engineering and keep looking to expand Nationally into new areas to continue to grow, then I believe they will find success in the years ahead.

Thank you for reading my Article about Vysarn.

Stuart G

Hey!

I’ve been following your content for a while, and I really enjoy your insights. I also run a Substack newsletter, Trade With Harshath, where I share trading strategies, forex insights, and market analysis.

Since we’re in a similar niche, I wanted to see if you’d be open to a mutual recommendation on Substack. I think our audiences could benefit from both perspectives. No worries if it’s not something you’re interested in—just thought I’d ask!

Let me know what you think. Looking forward to hearing your thoughts!